CORE BANKING SYSTEM - DEFINITION, FEATURES, AND BENEFITS

In today's digital age, the banking industry is undergoing a significant transformation. The advancement of technology has changed customer expectations, compelling banks to adopt innovative solutions to enhance operational efficiency and improve user experience. Modern core banking solutions are the secret to success for every bank. Whether traditional or modern, robust core banking solutions are essential for operational effectiveness, customer experience, regulatory compliance, and security.

Globally, the core banking solutions market is valued at over $14 billion. In India, this market is projected to grow at a CAGR of around 16%, reaching approximately $1,510.92 million by 2028. At Viettel Software, we recognize the critical role that core banking systems play in this transformation. This article will help you gain a deeper understanding of core banking systems and the benefits they offer.

What is a Core Banking System (CBS)?

Core banking solutions are systems that encompass key modules to handle the fundamental operations of banks, such as payment accounts, credit services, and customer care. Through this system, banks can develop a variety of new products and services while improving internal management and ensuring tighter operations. Core banking is software that integrates multiple information technology applications to manage information, assets, facilitate transactions, and manage risks within the banking system. It fully meets the requirements of modern commercial banks.

The foundational technology of core banking has brought about significant changes in banking operations, affirming the role of technology in enhancing competitive capability, expanding networks, and diversifying service delivery channels.

Key features of Core Banking

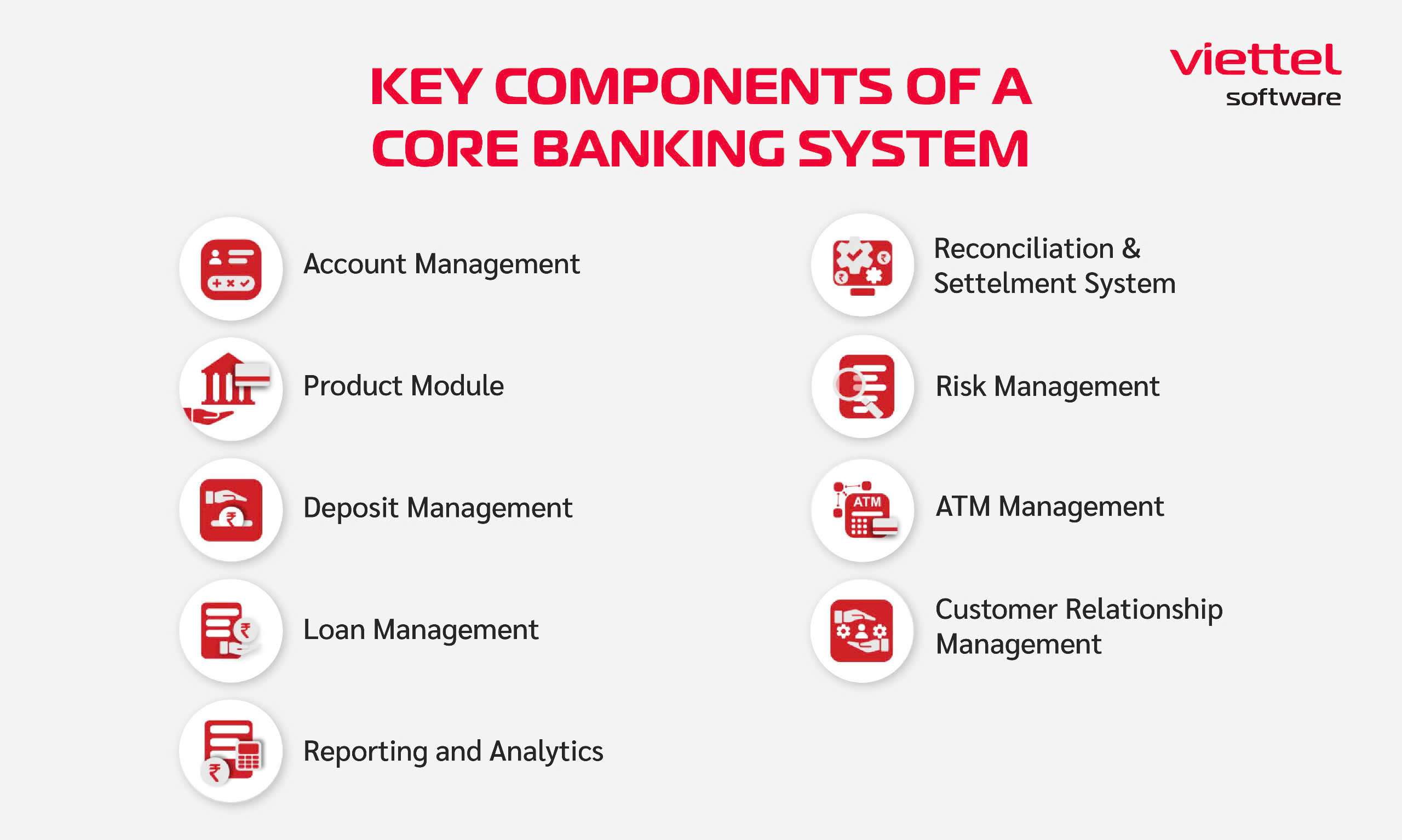

1. Account Management

The account management feature is at the heart of every core

banking system. It allows banks to open, close, and monitor

various account types, including savings accounts, checking

accounts, credit accounts, and more. The system enables customers

to perform transactions such as withdrawals, deposits, transfers,

and real-time balance inquiries. With effective account

management, banks can accurately track all customer activities,

ensuring security and comprehensive reporting.

2. Product Module

The core banking system provides flexible management capabilities

and quick deployment of new financial products. From savings and

credit products to payment cards and supplementary services like

insurance, banks can easily create, modify, and offer these

products according to customer needs. The product module also

supports customizing conditions, interest rates, and fee

structures to suit specific customer segments.

3. Deposit Management

The deposit management feature helps banks effectively manage

customer deposits, from savings accounts to fixed-term deposits.

This system automatically calculates interest rates, manages

transaction histories, and executes tasks like renewing deposits,

early withdrawals, or managing promotional programs. Optimizing

the deposit management process enhances customer trust and

satisfaction.

4. Reconciliation and Payment System

The core banking system can integrate domestic and international

payment protocols, allowing banks to process payment transactions

quickly and accurately. The automatic reconciliation feature

assists in verifying and adjusting transactions, ensuring no

errors or discrepancies occur. Additionally, the system offers

various electronic payment methods such as transfers, bill

payments, QR code payments, and other contactless

transactions.

5. Risk Management

In the context of the financial industry facing numerous risk

challenges, the core banking system provides advanced risk

management tools. This feature includes monitoring and assessing

credit risks, market risks, and operational risks. The system

helps banks generate real-time reports and alerts, optimizing

decision-making processes, ensuring compliance with regulatory

requirements, and preventing unwanted risks.

6. ATM Management

The ATM management system within core banking ensures smooth and

efficient operation of the ATM network. It manages all

transactions at ATMs, such as withdrawals, balance inquiries,

statement printing, and inter-account transfers. Moreover, this

system also monitors the technical status of ATMs, alerts for

issues, and assists in cash management at ATM locations.

7. Loan Management

The loan management system helps banks track and manage the

entire lending process, from application and approval to

monitoring and debt recovery. This feature includes calculating

interest rates, managing payment schedules, and tracking customer

debt status. Furthermore, the system supports various loan

programs such as unsecured loans, secured loans, and consumer

loans, ensuring a quick and transparent lending process.

8. Customer Relationship Management (CRM)

The core banking system integrates customer relationship

management (CRM) features, helping banks capture detailed

information about customers, from transaction history and

preferences to important personal information. This allows banks

to offer personalized products and services, enhancing customer

experience and loyalty. The CRM system also supports banks in

implementing marketing campaigns and customer service efficiently

and automatically.

9. Reporting and Analytics

Core banking provides powerful reporting and data analytics

tools, enabling banks to generate detailed financial reports,

monitor business activities, and evaluate the performance of each

branch. This data can be used to analyze trends, assess risks, and

forecast future performance, thereby supporting the strategic

decision-making process of the bank. The compliance reporting

feature also helps banks meet legal and audit requirements

accurately.

Benefits of Implementing a Core Banking System

1. Optimize Operational Efficiency

One of the greatest benefits of a Core Banking System is the

automation of operational processes, which minimizes manual errors

and saves time. This system enables banks to integrate and manage

activities such as transactions, account openings, payments, and

credit processing on a single platform. This not only reduces

operational costs but also increases labor productivity.

2. Improve Customer Experience

The Core Banking System allows banks to provide seamless, quick,

and personalized services to customers. Real-time transaction

processing enables customers to perform banking activities like

transfers, bill payments, and balance inquiries anytime and

anywhere, through various channels such as internet banking,

mobile banking, and ATMs. This enhances customer experience,

boosts satisfaction, and strengthens loyalty to the bank.

3. Comprehensive Financial Management

With the Core Banking System, banks can comprehensively manage

financial aspects such as checking accounts, deposits, credit, and

investments. The system helps accurately track and manage

transactions related to deposits, loans, interest rates, and other

promotional programs. This aids banks in better controlling cash

flow, minimizing risks, and enhancing transparency in financial

operations.

4. Enhanced Security and Regulatory Compliance

5. Integration and Synchronization of Multiple Transaction

Channels

Another important benefit of the Core Banking System is its

ability to integrate multiple transaction channels, from physical

branches and ATMs to digital platforms such as mobile banking and

internet banking. This allows customers to perform transactions

across all channels without interruptions, while banks can manage

these channels synchronously and efficiently.

6. Improved Analysis and Forecasting Capabilities

The Core Banking System enables banks to analyze customer and

market data comprehensively. Advanced reporting and analysis tools

within the system provide insights into customer behavior, market

trends, and operational performance. This helps banks optimize

existing products and services while supporting strategic

decision-making based on real data, fostering sustainable business

growth.

7. Support for Scalability and Product Development

The Core Banking System allows banks to easily scale operations

and develop new products and services. Thanks to its flexibility

and high customization capabilities, banks can quickly launch

credit products, payment cards, and digital banking services

tailored to the needs of specific customer groups. This enables

banks to swiftly respond to market demands and maintain

competitive advantage.

8. Enhanced Risk Management

The Core Banking System provides comprehensive risk management

tools, covering credit risk, market risk, and operational risk.

Banks can monitor risk indicators in real time, automatically

alerting them and enabling rapid response measures. As a result,

banks can minimize losses due to risks and better comply with risk

governance requirements from regulatory authorities.

9. Increased Competitive Edge

In the increasingly competitive financial market, the ability to

provide diverse and prompt services is a significant advantage.

The Core Banking System helps banks improve and offer modern

financial services, supporting business network expansion and

enhancing customer experience. This not only helps banks maintain

the trust of existing customers but also attracts new ones.

We hope that through the information shared above, you have gained a clearer understanding of the Core Banking System and related issues regarding core banking solutions. This knowledge will help you easily select and apply the most suitable solutions for managing and operating your banking activities. For further consultation on Core Banking solutions provided by Viettel Software, please contact us via email: contact@viettelsoftware.com or Hotline (+84) 988889446 for detailed and prompt assistance.